Exactly how to Pick the Right Offshore Investment Firm for Your Monetary Objectives

Exactly how to Pick the Right Offshore Investment Firm for Your Monetary Objectives

Blog Article

The Top Reasons for Taking Into Consideration Offshore Financial investment in Today's Economic climate

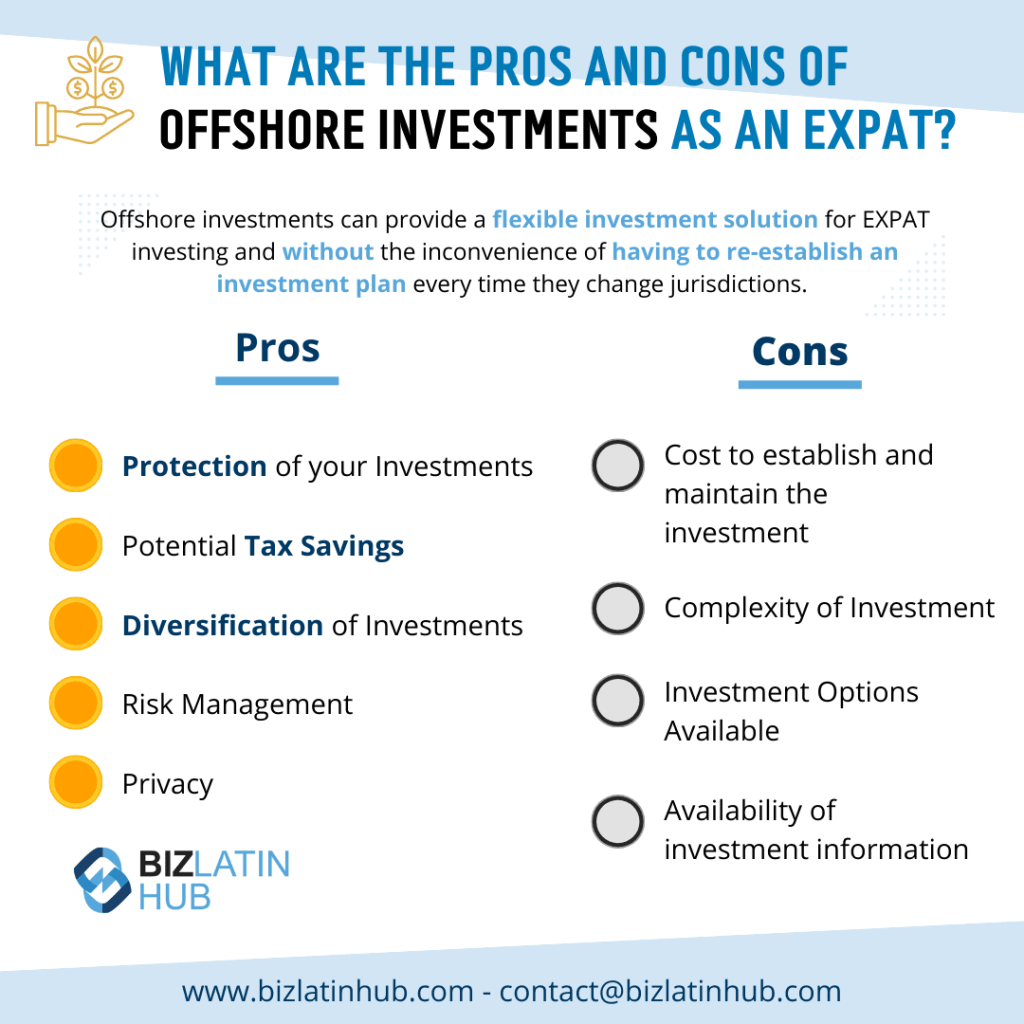

In the context of today's volatile financial landscape, the advantages of offshore investment warrant careful factor to consider. What specific benefits could offshore financial investments bring to your portfolio in the present environment?

Diversity of Financial Investment Profile

Among the key reasons financiers take into consideration offshore financial investments is the possibility for diversity of their financial investment portfolio. By assigning properties throughout numerous geographical regions and markets, financiers can minimize risks connected with concentrated financial investments in their home nation. This technique is particularly beneficial in an increasingly interconnected international economic situation, where financial slumps can have localized influences.

Offshore investments allow individuals to tap right into emerging markets, industries, and money that might not come through residential methods. Consequently, capitalists can possibly gain from unique development opportunities and hedge against volatility in their local markets. In addition, branching out right into foreign properties can minimize exposure to residential economic changes, rate of interest modifications, and political instability.

Along with geographical diversity, offshore investments typically encompass a series of property courses, such as stocks, bonds, realty, and alternate investments. This multifaceted method can improve risk-adjusted returns and offer a barrier versus market declines. Inevitably, the combination of international direct exposure and differed property classes placements financiers to attain long-term monetary objectives while browsing the complexities of global markets.

Tax Advantages and Cost Savings

Offshore financial investments likewise use significant tax obligation advantages and cost savings, making them an attractive alternative for capitalists looking for to enhance their economic strategies. Numerous territories give desirable tax obligation treatment, enabling investors to minimize their overall tax responsibilities. Particular overseas accounts might enable tax obligation deferment on funding gains up until withdrawals are made, which can be helpful for long-lasting investment growth.

Additionally, overseas structures can facilitate estate preparation, enabling people to move riches successfully while minimizing inheritance taxes. By utilizing depends on or other vehicles, financiers can secure their possessions from too much taxes and ensure smoother changes for future generations.

Additionally, some overseas territories impose little to no income tax obligation, giving possibilities for greater returns on financial investment. This can be particularly advantageous for high-net-worth individuals and companies seeking to maximize their funding.

Accessibility to Global Markets

In addition, spending offshore gives an one-of-a-kind opportunity to spend in industries and fields that are prospering in different areas. For example, technical developments in Asia or renewable resource efforts in Europe can provide check over here lucrative investment options. This geographical diversity not only lowers reliance on domestic economic cycles yet likewise alleviates dangers connected with local slumps.

Moreover, overseas investment platforms commonly provide financiers with a broader array of monetary instruments, including international supplies, bonds, mutual funds, and alternate possessions. Such a selection allows capitalists to customize their profiles according to their threat resistance and financial investment objectives, improving total portfolio resilience.

Enhanced Financial Personal Privacy

While keeping financial personal privacy can be testing in today's interconnected world, overseas investment strategies use a substantial benefit in this regard. Many investors seek to secure their financial info from analysis, and offshore jurisdictions supply legal frameworks that support discretion.

Offshore accounts and investment cars typically come with robust privacy regulations that limit the disclosure of account information. This is specifically useful for high-net-worth people and companies wanting to secure delicate monetary information from undesirable focus. Lots of territories also provide solid property protection procedures, ensuring that properties are secured from possible lawful conflicts or financial institutions.

Additionally, the complexities surrounding international financial regulations commonly mean that details shared between territories is minimal, additional enhancing privacy. Investors can benefit from different overseas structures, such as trusts or limited partnerships, which can supply extra layers of personal privacy and safety.

It is crucial, nevertheless, for financiers to abide with relevant tax laws and laws in their published here home countries when making use of overseas financial investments. By carefully navigating these needs, individuals can take pleasure in the advantages of improved financial personal privacy while sticking to lawful obligations. On the whole, overseas financial investment can act as a powerful tool for those seeking discretion in their financial affairs.

Protection Versus Financial Instability

Numerous capitalists acknowledge the importance of securing their possessions against economic instability, and offshore investments supply a sensible service to this concern (Offshore Investment). As global markets experience changes due to political stress, inflation, and unpredictable economic plans, diversifying financial investments across borders can minimize threat and enhance portfolio resilience

The diversity supplied by offshore investments likewise enables accessibility to emerging markets with development capacity, permitting calculated positioning in economic climates less impacted by international uncertainties. Therefore, financiers can stabilize their portfolios with possessions that might carry out well throughout domestic economic declines.

Conclusion

Finally, the consideration of offshore investment in the contemporary economic climate provides many benefits. Diversity of financial investment portfolios alleviates dangers related to domestic fluctuations, while tax advantages boost total returns. Accessibility to worldwide markets opens chances for growth, and enhanced financial privacy safeguards properties. In addition, overseas financial investments supply vital security against economic instability, outfitting capitalists with calculated positioning to efficiently navigate unpredictabilities. In general, the benefits of overseas financial investment are substantial and warrant mindful factor to consider.

One of the key reasons capitalists consider overseas investments is the chance for diversity of their investment profile.In addition to geographical diversity, overseas investments usually my review here include an array of asset courses, such as stocks, bonds, genuine estate, and different investments.Offshore investments additionally provide substantial tax benefits and financial savings, making them an attractive choice for investors seeking to maximize their monetary methods.Accessibility to global markets is an engaging benefit of offshore financial investment techniques that can significantly improve a capitalist's portfolio.Offshore investment options, such as foreign genuine estate, global common funds, and foreign money accounts, allow capitalists to shield their properties from neighborhood financial declines.

Report this page